Table of Content

For example, an employee could be working on a customer’s site for several weeks or might be posted temporarily to another company location for a short or long period. In those situations, the employee will incur expenses for meals and accommodation. We've explained everything you need to know about claiming work from home tax relief below. In order to compensate for these costs, last September the government announced the new tax-free work from home allowance , which came into effect on January 1, 2022.

The crucial point is, however, that your employer must have required or asked you to work from home for you to be able to claim. The online service is easy to use and takes just a few minutes to make a claim. The government has created a handyonline toolto help you get the working from home tax back. HMRC will, in fact, accept backdated claims for up to four years which means in total you could claim up to £561.60. Claims can also be made for the previous tax year, also worth up to £140.40, so anyone who's eligible for both years and hasn't yet claimed can get £280.80. And with energy bills at an all-time high, it's important to understand if you can get money back if you're forced to work from home due to severe weather.

How do I Apply for Remote Working Tax Relief?

In most cases that means that it should be in line with what you earn from self-employment. Be the first to hear about new product updates, tax news, webinars and events. HMRC may also ask to see how you calculated the figure for your work from home allowance, so keep a copy of the result. Select ‘Remote Working Relief' and insert the amount of expense at the ‘Amount Claimed’ section. (For 2018 and 2019, select ‘Other PAYE expenses’ under Tax Credits and Reliefs’). Mary uses the same method to see how much tax she can claim back on broadband.

If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. Some of the information on this website applies to a specific financial year. Make sure you have the information for the right year before making decisions based on that information. Once the application has been approved, your tax code for the tax year will be adjusted automatically. This could be because you've had the lights or heating on more because you're inside for longer, or you've used more internet than usual. But if you’re an Uber driver who spends most of the time on the road, you’re probably limited to the minimum of 25 .

Tax free allowance for working from home

We understand that due to COVID-19 your working arrangements may have changed. If you have been working from home, you may have expenses you can claim a deduction for at tax time. Martin Lewisrecently explained that some can still claim tax relief worth up to £280 if they worked from homein the previous two years. While for people who pay tax at the higher rate of 40%, you'd get £2.40 a week - or £124.80 per tax year. To be eligible, you will also have to have seen your household costs rise because of working from home.

This does not include times you may have brought work home to do outside your normal working hours. Items you buy, such as laptops, computers, office equipment and office furniture, are not allowable costs for Remote Working Relief. Remote work allowances also improve the relationships between employers and teams because they inherently create trust. When workers are given more autonomy and the free will to use their stipend as they see fit, richer connections develop.

How to apply for the working from home allowance

Usually, it’s the finance team at your organisation that handles employee expense claims, receipt reconciliation and reimbursements. But if this isn’t the first time that you’ve found yourself picking up the slack with expense claims, it might be time to nudge your company into the 21st century. The money is taken off your current tax bill that’s paid every month, meaning that you’ll keep slightly more of your salary. But if you wait to claim until the end of the tax year, you may receive a straight-up refund in the form of a cheque. If you reimburse at a higher rate, the employee will pay income tax and National Insurance contributions on the whole amount of the payment. For example, if you reimburse £20 for the late evening meal, rather than HMRC’s £15 rate, the employee will incur charges of £20.

This is a brief outline of the rules on paying employees a working away from home allowance. If you would like professional advice on any aspect of these rules, or would like confirmation that you are complying with HMRC’s rules, our team of experienced tax accountants will be glad to help. If you are based in London, for example, and an employee travels to your Cambridge office for a meeting, expenses incurred on that journey qualify. Occupancy expenses relating to your home, such as rent, mortgage interest, property insurance and land taxes, will not become deductible merely because you are required to work from home due to COVID-19. Because your occupancy expenses are not deductible, working from home during COVID-19 will not disqualify you from claiming the capital gains tax main residence exemption when you sell your home. Thousands of home-workers can still claim backdated tax relief on expenses incurred during the height of the Covid-19 pandemic.

After one and a half years of complaining about the extra costs of electricity, gas, toilet paper, and the lack of shitty office coffees, the Dutch finally won their work from home compensation. However, because the pandemic forced millions more people to work from home, the government upped the amount to £6 a week. And the rules were also temporarily changed so you didn’t need to prove that you worked from home regularly. Instead, it meant you could claim up to £140 per year even if you only worked from home for one day. If, due to the continuing pandemic and restrictions placed upon us, you have employees working from home, you are able to pay them by virtue of HMRC regulations £6 per week as a non-taxable expense.

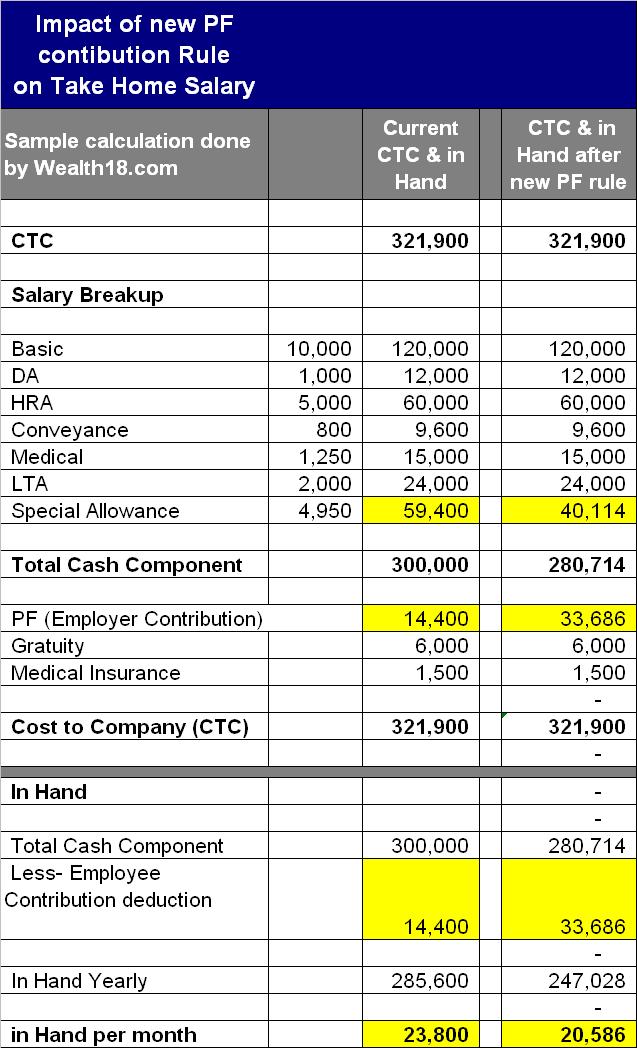

However, a standard rate would not yield the exact amount, possibly incurring a much higher payment rate. When using the reasonable method, your savings will be calculated by dividing your actual costs by the amount you use your home for work. One common way to do this is to divide your total household costs by the number of rooms you use when working from home, and/or the time you spend working from home. If they pay tax at the higher tax rate of 40% they will each get €37.20 back (40% of €93). If they pay tax at the lower rate of 20%, they will each get €18.60 back (20% of €93).

For the years 2018 and 2019, the relief for electricity and heating was also 10%, and calculated in the same way, but there was no relief for internet costs. You can apply for the tax relief after the end of the tax year or during the year. If you claim during the year, you can get real-time credits and have your tax reduced during the year. Again, this depends on where you’re claiming from and what’s being claimed for. Your status may also impact your claim, such as whether you’re self-employed or an employee working remotely.

This home-working allowance of 2 euros per day worked from home may also be given if an employee works from home for only a part of the day. Over a twelve-month period the employees could reduce their tax by £62.40 or £124.80 respectively. If you need an accountant to help with your tax return, our partners at Unbiased can match you with the right adviser. But some people will still be able to make a claim with HMRC giving the examples of if your job requires you to live far away from your office. In this case, evidence like receipts and other documentation is required.

For any allowable incidental expenses, HMRC sets limits of £5 per night for overnight stays in the UK and £10 per night for overnight stays outside the UK. Before reimbursing employees for the cost of allowable incidental expenses, make sure that the costs are not included in the hotel bill that you have reimbursed in full. This brief guide sets out the key requirements for paying and reporting a working away from home allowance. However, the rules and their interpretation by HMRC can be complex, so it may be useful to take professional advice if you are uncertain about a claim.

In a survey by the employers’ association AWVN, 60% of the inquired 450 Dutch companies replied that working 2 days from home can be the new norm. This new regulation is a tax-free allowance consisting of maximally 2 euros per day. This allowance is the extra costs for the employee that can be paid by the employer and includes for instance the water and electricity usage , heating, coffee, thee and even toilet paper.

For example, in 2022 the proportion would be the number of days working from home divided by 365. If your employer gives you equipment that you need to do your work, like a computer or printer, and you mainly use it for work, it is not considered a benefit in kind. This means that you do not have to pay any tax for getting the equipment from your employer. For many companies, the transition to remote work has been and continues to be a major pain point. Thus, seeking the help of a global professional employer organization could ease the burden.

No comments:

Post a Comment